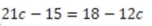

The value of c is 4 given the formula  .

.

Definitions:

Deferred Tax Asset

A tax benefit that refers to a reduction in a company's future tax liability due to deductible temporary differences and carryforwards.

FASB

The Financial Accounting Standards Board (FASB) is a private, non-profit organization standard-setting body whose primary purpose is to establish and improve Generally Accepted Accounting Principles (GAAP) within the United States in the public's interest.

Temporary Difference

A difference that arises between the tax bases of assets or liabilities and their carrying amount in the financial statements, which will result in taxable or deductible amounts in future years.

Q15: Geological Consultants Ltd. is a private company

Q25: A $300,000 mortgage is amortized over 20

Q53: If the C$ strengthens by 1.2% relative

Q56: Mutual Fund A charges an annual management

Q147: Use the currency exchange rates in Table

Q162: Express the following ratio in its lowest

Q163: Susan has a mortgage for $250,000 with

Q190: John and Jill agree to form a

Q218: Simplify the following: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4281/.jpg" alt="Simplify the

Q221: What amount, when reduced by 60% equals