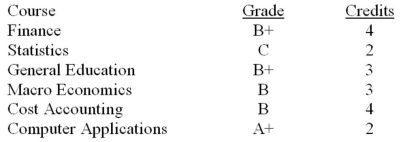

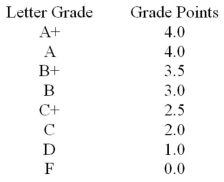

Jayelle took six courses last semester. Her grades and course credits are as follows:  Use the Letter Grade to Grade Point Value conversion table below to calculate her grade point average for the semester.

Use the Letter Grade to Grade Point Value conversion table below to calculate her grade point average for the semester.

Definitions:

Regressive Income Tax

A tax system where the tax rate decreases as the taxable amount increases, placing a higher relative burden on lower-income earners.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, reflecting the rate applied to each additional dollar of income.

Net Pay

The amount of money an employee receives after deductions like taxes and social security charges are subtracted from the gross pay.

Laffer Curve

A representation of the relationship between rates of taxation and the resulting levels of government revenue that illustrates there can be an optimum tax rate that maximizes revenue.

Q5: LIFS (last-in,first-served)is a common queue discipline,most often

Q7: A crew of mechanics at the Highway

Q68: Complete the following table in preparation for

Q74: Evaluate the answer correct to the cent:

Q75: If a final result of the order

Q100: Your firm has expertise with a special

Q123: Determine the future value (accurate to the

Q155: What amount would you have to invest

Q177: Evaluate: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4281/.jpg" alt="Evaluate: " class="answers-bank-image

Q352: Sam is paid $34.50 per hour as