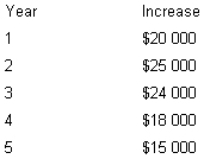

Bravo Pty Ltd is considering the addition of a new product line.The new product will require an initial capital outlay of $70 000 and is expected to have a five-year life cycle.The manager estimates that because of the new product,cash flow will increase over the next five years by the following amounts.If Bravo's hurdle rate is 14 per cent,calculate the net present value of the new product line.(Income taxes can be ignored. )

Definitions:

Perfectly Competitive

A market structure characterized by many sellers, homogeneous products, and free entry and exit, leading to price determination by supply and demand.

Long-Run Industry Supply Curve

The long-run industry supply curve shows how the quantity supplied by an industry varies with price once all adjustment has been made, including the entry and exit of firms.

Increasing-Cost Industry

An industry in which production costs rise as firms enter the market, often leading to higher prices for consumers.

Positive Profits

Financial gains achieved when the total revenues exceed the total costs of a business.

Q3: Line balancing<br>A)Assigns elements to work stations<br>B)Tries to

Q3: Suppose a firm has an asset that

Q3: On a CPM/PERT network if activity 3

Q6: A driverless truck that moves material along

Q11: Although the cost structure of a firm

Q14: _ classifies designs into families for easy

Q53: A firm currently makes a component,and requires

Q56: While there is a decision-making model,in many

Q63: A firm incurs manufacturing costs totalling $240

Q66: Because environmental issues span the extended value