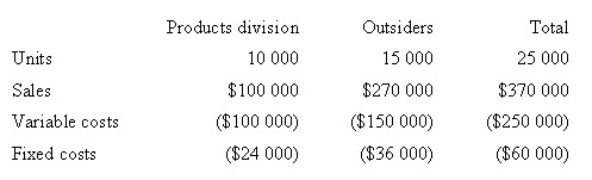

Corporate policy at Weber Pty Ltd requires that all transfers between divisions be recorded at variable cost as a transfer price.Divisional managers have complete autonomy in choosing their sources of customers and suppliers.The Milling Division sells a product called RK2.Forty per cent of the sales of RK2 are to the Products Division,while the remainder of the sales are to outside customers.The manager of the Milling Division is evaluating a special offer from an outside customer for 10 000 units of RK2 at a per unit price of $15.If the special offer were accepted,the Milling Division would be unable to supply those units to the Products Division.The Products Division could purchase those units from another supplier for $17 per unit.Annual capacity for the Milling Division is 25 000 units.The 2008 budget information for the Milling Division,based on full capacity,is presented below.Assume the company permits the division managers to negotiate a transfer price.The managers agree to a $15 transfer price adjusted to share equally the additional gross margin to Milling Division resulting from the sale to the Products Division.What is the agreed transfer price?

Definitions:

Avoidance Training

A learning process in which an individual learns to prevent the occurrence of an unpleasant or harmful stimulus by performing particular behaviors.

Desensitization

A psychological process of reducing sensitivity or reaction to a stimulus, often used in therapy to manage phobias or anxiety.

Negative Reinforcer

An undesirable outcome or event that, when removed after a behavior, increases the likelihood of that behavior occurring in the future.

Positive

Characterized by the presence or possession of certain qualities, attributes, or outcomes, often implying optimism or constructive aspects.

Q3: The following are the expected quality costs

Q4: Would you expect the following to be

Q7: The need to conform to legal regulations

Q8: A firm that uses a just-in-time purchasing

Q25: Framlingham uses a standard costing system for

Q29: Firm A has the following information:<br>What is

Q30: White Hills Ltd reported a return on

Q32: The Browning Company manufactures a single product;the

Q68: Cost volume profit analysis is a popular

Q92: Which of the following statements about the