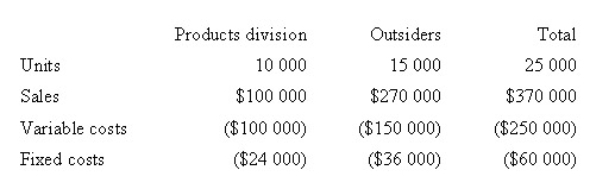

Corporate policy at Weber Pty Ltd requires that all transfers between divisions be recorded at variable cost as a transfer price.Divisional managers have complete autonomy in choosing their sources of customers and suppliers.The Milling Division sells a product called RK2.Forty per cent of the sales of RK2 are to the Products Division,while the remainder of the sales are to outside customers.The manager of the Milling Division is evaluating a special offer from an outside customer for 10 000 units of RK2 at a per unit price of $15.00.If the special offer were accepted,the Milling Division would be unable to supply those units to the Products Division.The Products Division could purchase those units from another supplier for $17 per unit.Annual capacity for the Milling Division is 25 000 units.The 2008 budget information for the Milling Division,based on full capacity,is presented below.Assume that demand increases for the Milling Division.All 25 000 units can be sold at the regular price to outside customers and the Product Division's annual demand declines to 5 000 units.What transfer price would be calculated under the general transfer-pricing formula?

Definitions:

Q6: The following dates apply to a specific

Q10: Employee satisfaction,absenteeism and employee suggestions implemented are

Q11: The costs arising from activities that benefit

Q13: DBC Company applies fixed overhead at $8

Q34: Chelonia Ltd manufactures small robot toys.It plans

Q38: Which of the following statements is true?

Q40: Which of the following is an appropriate

Q53: Which of the following managers is held

Q63: Which of the following types of environmental

Q68: The following information about Monfort Manufacturing is