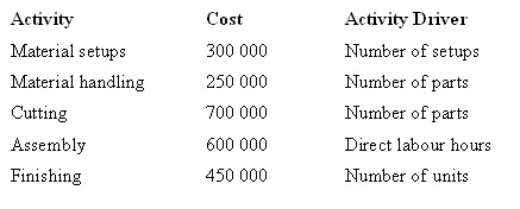

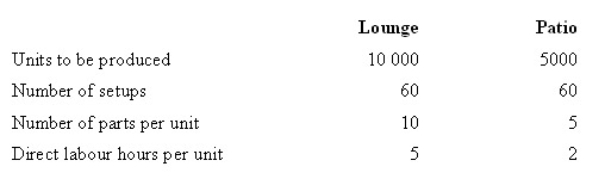

The Pinewood Furniture Company Pty Ltd plans to manufacture two lines of chairs in the coming year-lounge and patio.The company is considering introducing an activity-based costing system.Given below are each activity,its cost and its related activity driver.The level of activity for the year is:

Under an activity-based costing system,what is the activity cost per unit of activity driver for finishing?

Definitions:

Marginal Rate

The rate of increase in a variable (e.g., tax rate, substitution, technical substitution) as another variable (e.g., income, quantity of another good) increases incrementally.

Increase

An upward movement in quantity, value, or some other measure, indicating growth or accumulation.

Income Taxed

A government levy on individual or corporate income.

Regressive Tax Structure

A tax system where the tax rate decreases as the taxable amount increases, placing a higher burden on low-income earners compared to high-income earners.

Q4: A cost that remains unchanged in total

Q5: Adams Corporation has developed the following flexible

Q16: A manufacturer prepares a production budget.The comparable

Q19: The value chain for a service entity

Q21: Which of the following statements is false?<br>A)

Q22: Which of the following statements is/are false?<br>A)

Q42: The sales volume variance equals:<br>A) (actual sales

Q63: The following data relates to QA firm:<br>Cost

Q74: Management by exception is best defined as:<br>A)

Q76: Which of the following statements is correct?<br>A)