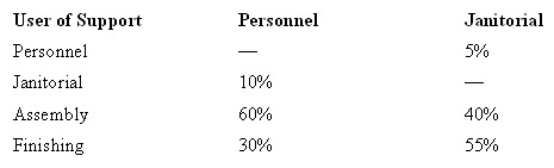

The Kelsey Manufacturing Company Ltd has two production departments (Assembly and Finishing) and two support departments (Janitorial and Personnel) .The usage of the two support departments in 2012 is as follows:

The budgeted costs in the support departments of 2012 were as follows:

Using the direct method,what is the Personnel Department cost allocated to the Assembly Department?

Definitions:

Unearned Revenue

Money received by an entity for a service or product yet to be delivered or performed.

Accrued Expense

Expenses that have been incurred but not yet paid or recorded in the financial statements.

Accrued Revenue

Income that has been earned through sales or services but has not yet been received or recorded.

Tenant

An individual or entity that occupies property or land rented from a landlord under a lease agreement.

Q11: In activity-based costing analysis,direct materials are classified

Q18: Hamilton has no excess capacity.If the company

Q30: Which of the following might you expect

Q56: Vebco manufactures a product requiring 0.5 grams

Q66: The estimation of the quantity of a

Q67: Which of the following is not typically

Q68: Jane Maxwell is a financial planner at

Q69: The realisation rate is:<br>A) the ratio of

Q74: Management by exception is best defined as:<br>A)

Q75: A correct interpretation of an unfavourable variance