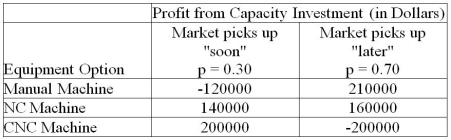

Steve Gentry,the operations manager of Baja Fabricators,wants to purchase a new profiling machine (it cuts compound angles on the ends of large structural pipes used in the fabrication yard).However,because the price of crude oil is depressed,the market for such equipment is down.Steve believes that the market will improve in the near future and that the company should expand its capacity.The table below displays the three equipment options he is currently considering,and the profit he expects each one to yield over a two-year period.The consensus forecast at Baja is that there is about a 30% probability that the market will pick up "soon" (within 3 to 6 months)and a 70% probability that the improvement will come "later" (in 9 to 12 months,perhaps longer).  a.Calculate the expected monetary value of each decision alternative.

a.Calculate the expected monetary value of each decision alternative.

b.Which equipment option should Steve take?

Definitions:

Statute of Frauds

A legal principle that requires certain types of contracts to be in writing and signed by the parties involved.

UCC

Uniform Commercial Code; a set of comprehensive laws governing all commercial transactions in the United States.

Oral Contract

A type of agreement that is made verbally and not recorded in written form, which can be legally binding if it meets certain criteria.

Subject Matter

the specific topic, content, or theme that is being discussed, studied, or dealt with.

Q11: The minimum record accuracy required for successful

Q15: Which of the following is not needed

Q21: In continuous (stock-to-forecast)operations,the master production schedule is

Q23: An oil change is to _ maintenance

Q31: What is FR(N)? How is it calculated?

Q44: A product has annual demand of 100,000

Q64: Identify the types of planning files used

Q71: A single-phase waiting-line system meets the assumptions

Q74: One goal of JIT partnerships is the

Q91: Your firm has expertise with a special