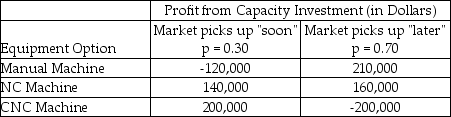

Steve Gentry,the operations manager of Baja Fabricators,wants to purchase a new profiling machine (it cuts compound angles on the ends of large structural pipes used in the fabrication yard).However,because the price of crude oil is depressed,the market for such equipment is down.Steve believes that the market will improve in the near future and that the company should expand its capacity.The table below displays the three equipment options he is currently considering,and the profit he expects each one to yield over a two-year period.The consensus forecast at Baja is that there is about a 30% probability that the market will pick up "soon" (within 3 to 6 months)and a 70% probability that the improvement will come "later" (in 9 to 12 months,perhaps longer).

a.Calculate the expected monetary value of each decision alternative.

a.Calculate the expected monetary value of each decision alternative.

b.Which equipment option should Steve take?

Definitions:

Stocks And Bonds

Stocks and bonds are financial instruments; stocks represent ownership shares in a company, while bonds are debt securities issued by entities like governments or corporations to raise capital.

Gross Domestic Product

The total market value of all final goods and services produced within a country in a given period, used as a broad measure of economic activity.

Exports

Goods or services produced in one country and sold to buyers in another country, contributing to the exporting country's gross domestic product.

Imports

Goods and services brought into a country from abroad for sale.

Q8: There are two jobs to be assigned

Q8: What is linear programming?

Q27: The earliest application of learning curves appears

Q28: Which of the following is an illustration

Q37: The _ probability distribution is a continuous

Q57: An iso-profit line:<br>A)can be used to help

Q67: The expected value of perfect information is

Q68: Why is it that many cases of

Q73: The transportation method is a special case

Q82: What combination of x and y will