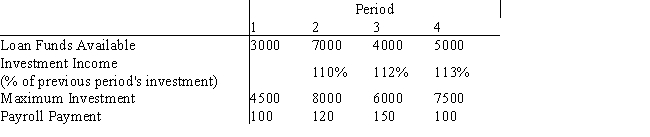

Information on a prospective investment for Wells Financial Services is given below.

In each period,funds available for investment come from two sources: loan funds and income from the previous period's investment.Expenses,or cash outflows,in each period must include repayment of the previous period's loan plus 8.5% interest,and the current payroll payment.In addition,to end the planning horizon,investment income from period 4 (at 110% of the investment)must be sufficient to cover the loan plus interest from period 4.The difference in these two quantities represents net income,and is to be maximized.How much should be borrowed and how much should be invested each period?

Definitions:

Payback Method

A method used in capital budgeting to estimate the time required to recoup the initial investment from its cash flows.

Payback

A method to evaluate investments by calculating the time needed to recoup the original investment.

Discount Factor

A multiplier used in time value of money calculations to determine the present value of a future sum or cash flow.

Straight-Line

A method of calculating depreciation of an asset, whereby its cost is evenly spread over its useful life.

Q14: All of the following are true about

Q19: The range of probability is<br>A)any value larger

Q25: Where is a fundamental matrix,N,used? How is

Q27: In a production scheduling LP,the demand requirement

Q41: The interpretation of the dual price for

Q46: If the optimal production lot size decreases,average

Q50: When there is probabilistic demand in a

Q54: In this portion of an Excel spreadsheet,the

Q66: Constraints in a transshipment problem<br>A)correspond to arcs.<br>B)include

Q79: Variance is<br>A)a measure of the average,or central