The cost of goods sold for the Immaculate Corporation for the month of April 2016 was $450,000. Work-in-process inventory at the end of April was 95 percent of the work-in-process inventory at the beginning of the month. Overhead is 80 percent of the direct labor cost. During the month, $110,000 of direct materials were purchased. Revenues for Immaculate were $600,000, and the selling and administrative costs were $70,000.

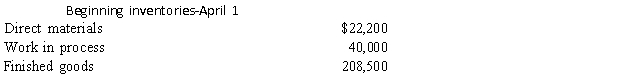

Other information about Immaculate's inventories and production for April was as follows:

Required:

Required:

a. Prepare a cost of goods manufactured and cost of goods sold statements.

b. Prepare an income statement.

c. What are the prime costs, conversion costs, and period costs?

Definitions:

Retention Strategies

Methods and practices aimed at keeping employees engaged and motivated to reduce turnover and retain talent within an organization.

Developmental Move

A job change within an organization that promotes growth, learning, and skill enhancement for an employee.

Dry Promotion

A promotion where an employee is given a higher title or rank without a corresponding increase in pay or benefits.

Lateral Transfer

A move by an employee to another job within the same organization at the same level, usually with similar pay and responsibilities.

Q11: Manufacturing environment automation is associated with increases

Q13: All of the following costs are included

Q23: Work in process consists of all partially

Q28: Contrast the role of the financial vice

Q59: Cost management information systems further competitive advantage

Q64: What is the difference between a staff

Q83: In resolving an ethical conflict, which of

Q87: Assume the following information for the Blue

Q101: Generally, more managerial objectives can be met

Q143: Only Certified Public Accountants are permitted by