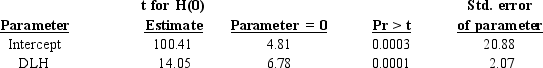

Figure 3-7

The following computer printout estimated overhead costs using regression:

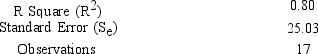

Please find the following statistical table

Please find the following statistical table

During the last accounting period 10,000 DLH were worked

During the last accounting period 10,000 DLH were worked

.

-Refer to Figure 3-7. The hypothesis tests of the cost parameters indicate(s) that

Definitions:

Income Connected

Relates to earnings or revenue that is directly related to a specific source or activity, often used in legal or tax contexts.

Standard Mileage Rate

A set rate per mile set by the IRS that taxpayers can use to calculate deductions for the business use of a vehicle.

Business Deduction

Expenses incurred in the operation of a business that can be subtracted from its income to reduce the taxable income.

Vehicle Expenses

Costs associated with the operation, maintenance, and use of a vehicle for business purposes, including fuel, repairs, and insurance.

Q18: Refer to Figure 6-4. What are the

Q50: Refer to Figure 4-11. What is the

Q53: Refer to Figure 2-15. Chrome Ponies Enterprises'

Q57: Order-getting costs would NOT include<br>A) marketing costs.<br>B)

Q122: The Knapp Company needs to predict the

Q123: Which of the following is a cost

Q125: What is a disadvantage of assigning costs

Q129: Multiple regression has or independent variables.

Q148: See Figure 3-1. What is the total

Q171: Refer to Figure 6-7. What is the