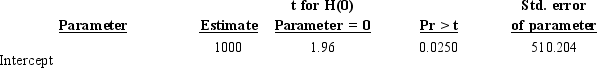

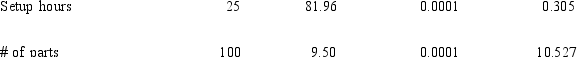

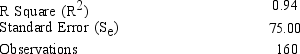

Figure 3-8

The following computer printout estimated overhead costs using multiple regression:

During the year the company used 1,000 setup hours and 500 parts.

During the year the company used 1,000 setup hours and 500 parts.

-Refer to Figure 3-8. The model being measured is

Definitions:

NPVGO

Net Present Value of Growth Opportunities; a valuation method that calculates the present value of investment opportunities a company is expected to undertake in the future.

Above Average P/E Multiple

A valuation metric indicating that a company's current share price is higher relative to its per-share earnings than the industry or overall market average.

Risk-adjusted Equity Cost

A method of determining the cost of equity capital that incorporates the risk associated with the equity investment.

Price Earnings Ratio

A valuation metric that compares a company's share price to its per-share earnings, used to evaluate if a stock is over or under-valued.

Q7: Refer to Figure 6-11. There were 3,750

Q56: Refer to Figure 3-6. Using a computer

Q57: Order-getting costs would NOT include<br>A) marketing costs.<br>B)

Q74: Activity-based costing might have a role in

Q77: Refer to Figure 6-15. What are the

Q77: The activity level is the production level

Q104: The information system is primarily concerned with

Q120: Refer to Figure 6-5. If a total

Q147: What does a correlation coefficient near +1

Q163: A key input to the cost of