Figure 4-18

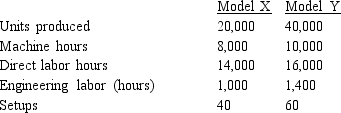

Marion Manufacturing uses an activity-based costing system. The company produces Model X and Model Y. Information relating to the two products is as follows:

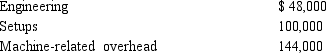

The following costs are reported:

The following costs are reported:

-Refer to Figure 4-18. Machine-related overhead would be classified as a

Definitions:

Unearned Subscription Revenue

Income received from subscriptions before the service has been fully delivered or the term of the subscription has been fulfilled.

Liability

Financial obligations or debts that an entity owes to another party, which need to be settled over time through the transfer of economic benefits including money, goods, or services.

Adjusting Entry

An adjusting entry, in accounting, is utilized to update the records for expenses and revenues that have accrued but not yet been recorded in the general ledger by the end of an accounting period.

Accumulated Depreciation

The cumulative amount of depreciation expense recorded for fixed assets over their useful lives, reflecting the decline in the assets' value from wear and tear or obsolescence.

Q49: Refer to Figure 6-17. The equivalent units

Q77: The activity level is the production level

Q88: Managers agree that the ideas behind the

Q88: The association of production costs with the

Q113: Producing departments create products and services to

Q122: Refer to Figure 5-7. What is the

Q122: Support department cost to the producing departments

Q158: Which of the following costs is an

Q173: An alternative measure of goodness of fit

Q174: Refer to Figure 6-13. If materials were