Figure 4-21

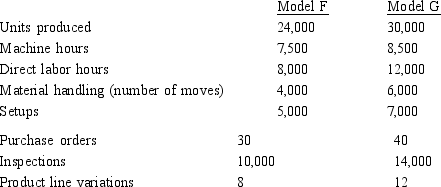

Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:

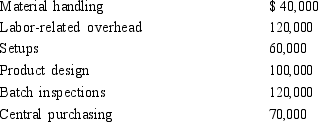

The following overhead costs are reported for the following activities of the production process:

The following overhead costs are reported for the following activities of the production process:

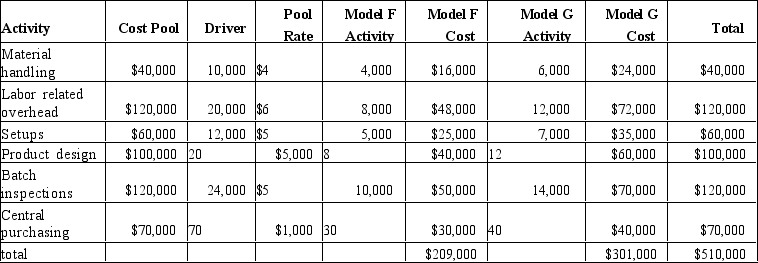

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

-Refer to Figure 4-21. Under this new approach, which two activities would be selected as the cost pools?

Definitions:

Self-focus

A psychological state where an individual's attention is concentrated on themselves, their feelings, thoughts, and actions.

Sexual Harassment

Unwelcome sexual advances, requests for sexual favors, and other verbal or physical behavior of a sexual nature that affects an individual's employment or creates a hostile environment.

Repeated Unwanted

Continuous occurrences of undesirable or unpleasant actions or events that persist despite efforts to stop them.

Deliberate

Done consciously and intentionally, often after careful thought or as a result of a decision.

Q23: In the formula Y = F +

Q32: Departmental overhead rate is computed by dividing

Q72: Unit-based product costing uses which of the

Q74: Allocation is not necessary when using JIT

Q78: Refer to Figure 6-14. The cost of

Q106: The average activity that a firm experiences

Q126: The following information pertains to the Springfield

Q146: Which joint cost allocation method is described

Q173: Services that are basically homogeneous and repetitive

Q193: Highestec, Inc., is beginning the production of