Figure 4-21

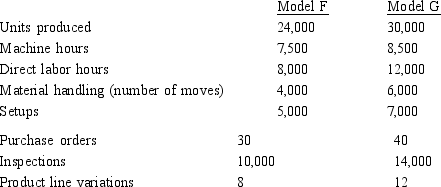

Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:

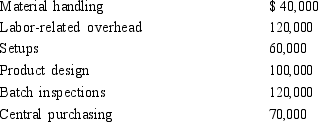

The following overhead costs are reported for the following activities of the production process:

The following overhead costs are reported for the following activities of the production process:

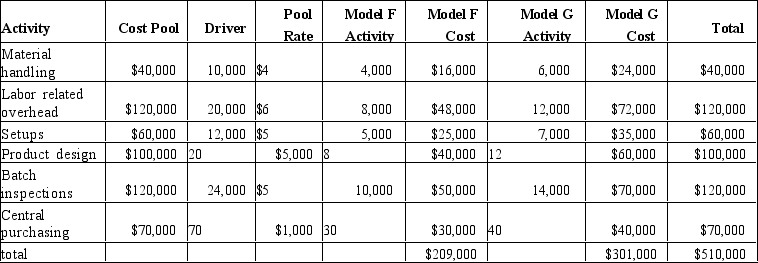

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

-Refer to Figure 4-21. Under this new approach using the new rates, what are the overhead costs assigned to Model G in this approximately relevant ABC system?

Definitions:

Task Environment

The immediate external elements including competitors, customers, suppliers, and regulatory agencies that directly influence an organization's operations and performance.

Competitors

Businesses or individuals that are in the same market and vie for the same customers or resources.

Employees

Individuals who are hired by a company or organization to perform specific duties in exchange for compensation, such as wages or salaries.

Integration

The process of combining or coordinating separate elements of an organization or system to function together effectively.

Q20: Refer to Figure 2-13. What are the

Q21: Which of the following costs is a

Q25: What is the unit cost per tax

Q25: The following excel printout provides information to

Q29: Which of the following is NOT an

Q35: Which of the following would be the

Q35: Refer to Figure 4-21. Under the equally

Q58: Refer to Figure 4-18. Machine-related overhead would

Q132: Hotchkiss Company has two support departments, Maintenance

Q161: In operation costing, the process which produces