Figure 4-21

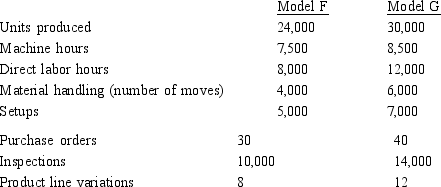

Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:

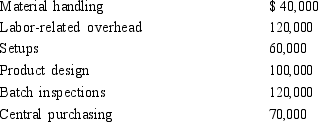

The following overhead costs are reported for the following activities of the production process:

The following overhead costs are reported for the following activities of the production process:

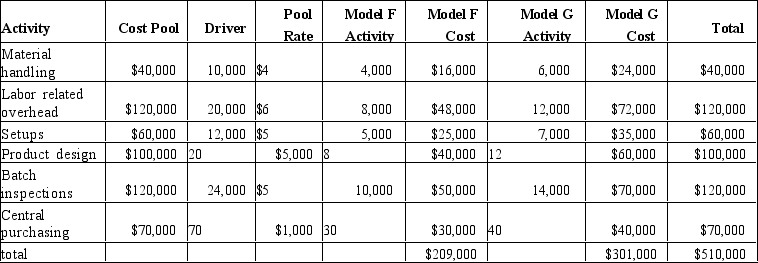

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

-Refer to Figure 4-21. Under this new approach, which two activities would be selected as the cost pools?

Definitions:

Gross Profit

The financial gain obtained after deducting the cost of goods sold from sales revenue, before subtracting any operating expenses.

Net Present Value

It's the calculation of the present value of all cash entering minus the present value of all cash exiting over a certain period.

Sales Quantity

The total number of units sold within a specific period.

Discounted Payback Period

The period of time it takes for an investment's cash flows, discounted back to the present value, to cover its initial cost.

Q7: are mutually beneficial costs to joint product

Q95: In the formula Y = F +

Q98: The first step in designing an activity-based

Q116: In the formula Y = F +

Q124: Activity-based costing assigns cost to cost objects

Q132: Tornado Enterprises has the following information available

Q136: Refer to Figure 5-9. If the spoilage

Q137: Given the following information:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2045/.jpg" alt="Given

Q149: The proportion of an overhead activity consumed

Q164: Hunghi Company has three support departments whose