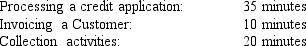

Bayview Manufacturing Company has an accounts receivable department that performs three activities within the department: processing customer credit applications, invoicing customers, and performing collection activities. During interviews, the employee survey reports that they spend 15 percent of their time processing credit applications, 55 percent of their time invoicing customers, and 30 percent of their time on collection activities. The accounts receivable department employs 10 associates for a total cost of $200,000. Assume each associate works 8 hours per day, 20 days per month, but an estimate of practical capacity is 80 percent. After close observation of the employee's daily work, managers conclude the following:

The estimated monthly quantities of work in the three activities are 500 credit applications, 18,000 invoices, and 900 collection calls.

Required:

1. Under a traditional ABC system, what is the cost of one unit of activity?

2. Assuming the practical capacity information, what is the cost per minute of supplying capacity?

3. Under time-driven ABC, what are the cost driver rates for each activity?

Definitions:

Less Developed Countries

Countries characterized by low levels of income, industrialization, and modernization, and often marked by high rates of poverty and economic vulnerability.

Stratified

Divided or classified into different levels, classes, or groups, often based on certain criteria or characteristics.

Prosperous

Describes a state of being successful, usually financially, characterized by growth, wealth, and good fortune.

Legitimized

Recognized as valid, lawful, or acceptable, often through formal endorsement or widespread acceptance.

Q16: Which of the following methods allocates joint

Q27: An activity-based costing system uses which of

Q45: Refer to Figure 4-5. How much overhead

Q54: Collossal Company uses a predetermined rate to

Q58: Conversion costs do NOT include<br>A) direct materials.<br>B)

Q61: Refer to Figure 7-5. Support department costs

Q76: Refer to Figure 7-4. Support department costs

Q100: The document which indicates the type and

Q126: If production volume increases from 16,000 to

Q127: Maroone, Inc., has identified the following overhead