Consequence Printing operates a Graphics business at two different locations. Consequence Printing has one support department that is responsible for cleaning, service, and maintenance of its printing equipment. The costs of the support department are allocated to each Graphics Center on the basis of total prints made.

During the first month, the costs of the support department were expected to be $100,000. Of this amount, $30,000 is considered a fixed cost. During the month, the support department incurred actual variable costs of $64,000 and actual fixed costs of $36,000.

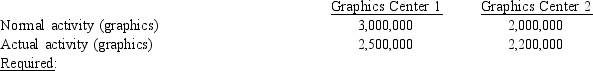

Normal and actual activity (prints made) are as follows:

a. For purposes of performance evaluation, calculate the fixed costs allocated to Graphics Center 1.

b. For purposes of performance evaluation, calculate the fixed costs allocated to Graphics Center 2.

c. Calculate the support department costs not allocated to the two Graphics Centers.

Definitions:

Retained Earnings

Retained earnings are the portion of a company's profits that are kept or retained by the company for reinvestment in its operations, rather than being distributed to its shareholders as dividends.

Tax Rate

The percentage at which an individual or corporation is taxed.

Depreciable Non-Current Asset

A long-term asset subject to depreciation, which systematically reduces its book value over its useful life to account for wear and tear.

NCI Share

NCI Share refers to Non-Controlling Interest share, which is the portion of equity in a subsidiary not attributable directly or indirectly to the parent company.

Q6: The following information pertains to the three

Q9: If production was budgeted at 400 units

Q25: Refer to Figure 7-3. Assuming a single

Q61: Which of the following costs is usually

Q66: Which of the following changes would NOT

Q88: Refer to Figure 7-7. What is the

Q115: Which of the following is NOT an

Q126: What are the source documents used in

Q136: Which of the following is the most

Q182: Moriah Manufacturing Company expects to incur the