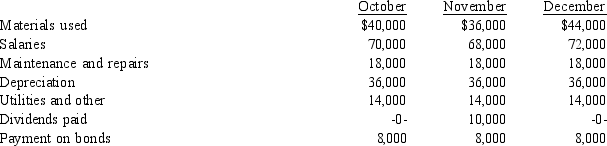

Sales for October, November, and December are expected to be $200,000, $180,000, and $220,000, respectively, for the Gurumai Company. All sales are on account (terms 2/15, net 30 days) and are collected 50 percent in the month of sale and 50 percent in the following month. One-half of all sales discounts are taken on the average. Materials are purchased one month before being needed, and all purchases and expenses are paid for as incurred. Activities for the quarter are expected to be:

Required:

Required:

Using the given information, prepare a cash budget for November.

Definitions:

Overhead Costs

Expenses related to the day-to-day operations of a business that are not directly tied to the production of goods or services, such as rent, utilities, and administrative salaries.

Equipment Depreciation

The process of spreading out the cost of physical assets over their useful lives for accounting and tax purposes.

Supervisory Expense

Costs associated with the salaries and benefits of supervisory staff, including managers and team leaders.

Activity-Based Costing

A costing methodology that assigns overhead and indirect costs to specific activities, thereby providing more accurate product costing and profitability analysis.

Q31: Wheeling Company produces and sells bikes. It

Q71: Refer to Figure 6-14. The cost of

Q77: Which of the following process dimensions of

Q81: Price standards specify amounts and quantity standards

Q82: Biscuit Company has developed the following standards

Q86: Transferred-in costs are accounted for in the

Q94: The first link of the internal value

Q95: The transfer price is revenue to the

Q126: The following information pertains to the three

Q165: Departmental overhead is applied to products passing