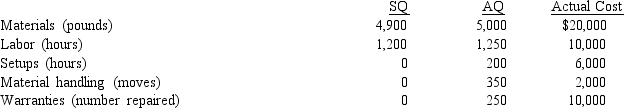

Metropolitan, Inc., sells one of its products for $40 each. Sales volume averages 2,000 units per year. Recently, its main competitor reduced the price of its product to $28. Metropolitan expects sales to drop dramatically unless it matches the competitor's price. In addition, the current profit per unit must be maintained. Information about the product (for production of 2,000) is as follows:

Required:

Required:

a. Calculate the target cost for maintaining current market share and profitability.

b. Calculate the non-value-added cost per unit.

c. If non-value-added costs can be reduced to zero, can the target cost be achieved?

Definitions:

Increases In Interest Rates

A scenario where central banks or financial institutions decide to raise the cost of borrowing money.

Cap

An upper limit set on the amount of money that can be charged or paid in a certain situation, such as interest rates on a loan or fees.

Cross-Hedging

Cross-hedging involves using a hedge to manage risk by investing in a financial instrument that is not directly correlated to the underlying asset but has similar price movements.

Hedge Price

A price locked in through hedge contracts to reduce exposure to price fluctuations of commodities, currencies, or securities.

Q31: According to the robust view, the strategy

Q70: A difference between Toyota's lean manufacturing system

Q76: The total product, the complete range of

Q77: Dot Company sells a product for $225

Q81: Mattison Company has developed cost formulas for

Q102: Fixed manufacturing overhead was budgeted at $105,000,

Q106: Production of a product utilizes materials D,

Q107: Which of the following factors would cause

Q111: Which of the following features make stretch

Q113: The outcome measures that can be readily