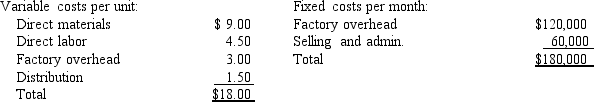

Hobart Company produces speakers for PA systems. The speakers are sold to retail music stores for $30. Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail music stores. The current production and sales

The variable distribution costs are for transportation to the retail music stores. The current production and sales

Volume is 20,000 per year. Capacity is 25,000 units per year.

A Memphis manufacturing firm has offered a one-year contract to supply speaker parts at a cost of $6.00 per unit. If Hobart Company accepts the offer, it will be able to reduce variable costs by 30 percent and rent unused space to an outside firm for $18,000 per year. All other information remains the same as the original data. What is the effect on profits if Hobart Company buys from the Memphis firm?

Definitions:

Asset Ownership

The legal right or interest that a person or entity has in items of value, such as property, investments, or intellectual property.

Families in Canada

Groups of individuals related by blood, marriage, partnership, or adoption, residing in or originating from Canada, characterized by diverse structures and dynamics.

Income

The money received by an individual or group for work, through investments, or from other sources, usually measured over a period of time.

Wealth

An abundance of valuable possessions or money, often considered the stock of valuable resources or material possessions of an individual, community, or country.

Q52: In the activity resource model, flexible resources

Q57: Hobart Company produces speakers for PA systems.

Q86: Decisions concerned with the process of planning,

Q88: Los Gatos Shop is considering the purchase

Q92: Maroone Corporation reported the following operating costs

Q95: Lorillard Corporation has the following information for

Q100: A linear programming model would NOT include

Q118: Lexamoor Products Corporation produces two products. The

Q118: Labor and overhead incurred for rework of

Q173: A quality report that compares current actual