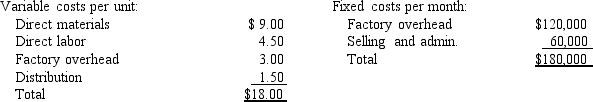

Hobart Company produces speakers for PA systems. The speakers are sold to retail music stores for $30. Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail music stores. The current production and sales

The variable distribution costs are for transportation to the retail music stores. The current production and sales

Volume is 20,000 per year. Capacity is 25,000 units per year.

The speakers are currently unpackaged. Packaging them individually would increase costs by $1.20 per unit. However, the units could then be sold for $33.00. All other information remains the same as the original data. What is the effect on profits if Hobart Company packages the speakers?

Definitions:

Income Statement

A financial statement that shows a company's revenues and expenses over a specific period, leading to net profit or loss.

Times Interest Earned

A financial ratio that measures a company's ability to meet its debt obligations based on its earnings before interest and taxes.

Net Income

The total profit of a company after all expenses, taxes, and costs have been deducted from total revenue.

Income Tax Expense

The amount of money a company or individual owes to the government based on the taxable income for a given period.

Q3: The following information pertains to Molotov, Inc.,

Q16: In the long run,the most helpful action

Q22: If the net present value is greater

Q43: Custom Choppers, Inc. produces two types of

Q83: Which of the following is a reason

Q91: Peyton Place Corporation had the following income

Q139: The departments or cells that contain all

Q157: Maldovar Chemical produces a number of chemical

Q173: A quality report that compares current actual

Q187: Refer to Figure 14-3. For the current