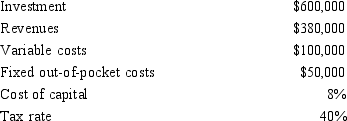

Information about a project Wunderbar Company is considering is as follows:  The property is considered 5-year property for tax purposes. The company plans to use MACRS and dispose of the

The property is considered 5-year property for tax purposes. The company plans to use MACRS and dispose of the

Property at the end of the sixth year; no salvage value is expected. Assume all cash flows occur at the end of the year. Round amounts to dollars.

The tax savings from depreciation in Year 2 would be

Definitions:

Reflection

The process of introspectively considering one's thoughts, feelings, and actions, and the outcomes they lead to, for the purpose of learning and self-improvement.

Reinforcing

Strengthening a behavior or response by providing a reward or positive outcome after the behavior occurs, often used in learning and behavior modification techniques.

Sending

The act of transmitting information, messages, or goods from one place or person to another.

Proxemics

Involves the use of space as people interact.

Q7: When a government imposes a price floor

Q11: Galveston Corporation is considering an investment in

Q12: The rationing function of price<br>A)occurs when there

Q12: Charting observations on a semi-logarithmic graph will

Q16: A perfectly elastic demand curve<br>A)can be represented

Q27: Octagonal Company has the following information for

Q50: How could a manager use the information

Q61: A one-tail test of significance would be

Q90: When only one binding constraint exists, the

Q99: Senior Company currently buys 35,000 units of