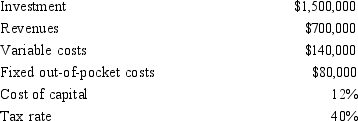

Information about a project Dalwhinnie Company is considering is as follows:  The property is considered 5-year property for tax purposes. The company plans to use MACRS and dispose of the

The property is considered 5-year property for tax purposes. The company plans to use MACRS and dispose of the

Property at the end of the sixth year. No salvage value is expected. Assume all cash flows occur at the end of the year. Round amounts to dollars.

The tax savings from depreciation in Year 2 would be

Definitions:

Swap Contract

An agreement between two parties to exchange sequences of cash flows for a set period of time according to predetermined terms.

Forward Contract

An agreement customized for two individuals to either buy or sell a particular asset at a price decided upon for a future date.

Hedging

A strategy used to reduce or eliminate the risk of adverse price movements in an asset, often by taking an offsetting position in a related security.

Transformation Process

The series of actions or operations conducted in manufacturing or service environments that convert inputs into finished products or outcomes.

Q11: Why might a concentration ratio be a

Q21: The following information about Morgantown Avionics' two

Q34: A disadvantage of absorption costing is<br>A) that

Q41: Effective inventory management does not consider inventory-related

Q45: For flexible resources, which of the following

Q45: When a firm produces at the point

Q52: The fact that a perfectly competitive firm

Q57: Which of the following methods consider the

Q74: The focus on the goal of making

Q91: Zildjian Corporation manufactures a single product with