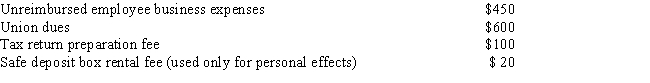

Peter is a plumber employed by a major contracting firm.During the current year,he paid the following miscellaneous expenses: If Peter were to itemize his deductions for the current year,what amount could he claim as miscellaneous itemized deductions (before applying the 2 percent of adjusted gross income limitation) ?

Definitions:

Immediatists

Individuals or movements advocating for the immediate action or change, particularly in the context of abolishing slavery without delay.

Policies

are principles or courses of action adopted or proposed by an organization, government, or individual, intended to guide decisions and achieve rational outcomes.

Mid-Nineteenth Century

Refers to the period from 1850 to 1860, a time characterized by significant social, economic, and political changes in the United States, often associated with pre-Civil War tensions.

American Society

A complex entity characterized by a diverse population, cultural pluralism, and a democratic political system.

Q21: Which of the common deductions below are

Q21: Eva purchased office equipment (7-year property)for use

Q21: In 2017,Willow Corporation had three employees.Two of

Q29: Jack is a lawyer and Jeri is

Q71: If a taxpayer is relieved of a

Q76: Charlie is a single taxpayer with income

Q86: What is the maximum investment income a

Q89: Steve goes to Tri-State University and pays

Q93: The IRS has approved only two per

Q95: Since a contribution to an IRA is