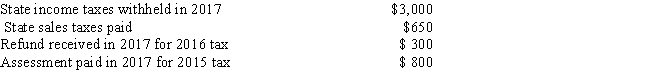

Weber resides in a state that imposes a tax on income.The following information relating to Weber's state income taxes is available: What amount should Weber use as state and local income taxes in calculating itemized deductions for his 2017 Federal income tax return?

Definitions:

Multichannel Retailers

Retailers that utilize and integrate a combination of traditional store formats and nonstore formats such as catalogs, television home shopping, and online retailing.

Intertype Competitors

Businesses that offer different products or services but compete for the same customers.

Dual Distributors

Companies or individuals that utilize more than one distribution channel or method to reach their consumers or the market.

Nonstore Formats

Retail channels that do not involve a traditional brick-and-mortar store, including online shopping, direct selling, and automatic vending.

Q2: Greg,a self-employed plumber,commutes from his home to

Q9: Wanda is a single taxpayer and an

Q31: For each of the following independent situations,indicate

Q51: Amounts received by an employee as reimbursement

Q53: Anna is a self-employed newspaper columnist who

Q59: A taxpayer with self-employment income of $600

Q88: Regardless of a taxpayer's involvement in the

Q92: Which of the following is correct?<br>A)An individual

Q102: Jim,a single individual,was unemployed for a few

Q115: The expense of travel as a form