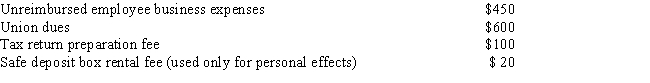

Peter is a plumber employed by a major contracting firm.During the current year,he paid the following miscellaneous expenses: If Peter were to itemize his deductions for the current year,what amount could he claim as miscellaneous itemized deductions (before applying the 2 percent of adjusted gross income limitation) ?

Definitions:

Capacity Analysis

Identifying the necessary manufacturing capacity a business must have to respond to varying product demands.

Time-Driven Activity-Based Costing

A costing methodology that assigns costs to products or services based on the actual time spent on each activity, allowing for more accurate and dynamic cost assessments.

Customer Service Department

This department is responsible for providing assistance and advice to the customers of a company, handling inquiries, complaints, and support requests.

Capacity Analysis

The procedure of figuring out what level of manufacturing capacity is needed by a company to adjust to its products' changing needs.

Q2: Greg,a self-employed plumber,commutes from his home to

Q3: List each alternative filing status available to

Q11: Barry is age 45 and a single

Q32: For purposes of the passive loss rules,income

Q38: Jasper owns a small retail store as

Q63: Which of the following is true of

Q63: Stewart had adjusted gross income of $22,000

Q75: Partnership capital gains and losses are allocated

Q76: On January 1,2017,Sandy,a sole proprietor,purchased for use

Q108: Amended individual returns are filed on:<br>A)Form 1040X<br>B)Form