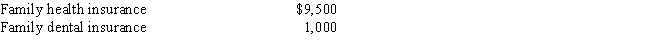

Mike and Rose are married and file jointly.Mike earns $45,000 from wages and Rose reports $450 on her Schedule C as an artist.Since Mike's work does not offer health insurance,Rose pays the following health insurance premiums from her business account:

How much can Mike and Rose deduct as self-employed health insurance?

Definitions:

Breeders

Individuals within a population that are of reproductive age and actively participate in mating and producing offspring.

Direct Benefits

Benefits that directly improve the fitness of an individual receiving them, often in the context of mate choice, including improved nutrition, protection, or resources.

Seychelles Warblers

A small bird species native to the Seychelles islands, known for its cooperative breeding behaviors.

Conservation Efforts

Actions taken to protect, preserve, or restore wildlife and natural habitats to prevent biodiversity loss and species extinction.

Q13: Which of the following sales results in

Q21: Eva purchased office equipment (7-year property)for use

Q33: Irma,widowed in 2016,pays all costs related to

Q48: Van is sick and tired of his

Q54: Although the alternative minimum tax (AMT)is meant

Q61: Taxpayers must use the straight-line method of

Q78: For purposes of determining the adjusted basis

Q81: For 2017,which of the following is a

Q93: If insurance proceeds exceed the taxpayer's basis

Q116: For 2017,Eugene and Linda had adjusted gross