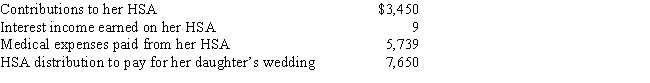

Miki,who is single and 57 years old,has a quaifying high-deductible insurance plan.She had the following transactions with her HSA during the year:

a.How much may Miki claim as a deduction for adjusted gross income?

b.What is the amount that Miki must report on her federal income tax return as income from her HSA?

c.How much is subject to a penalty? What is the penalty percentage?

Definitions:

Civil War

A military conflict within a country, fought between factions or regions seeking control or advocating for specific political or social changes.

Lincoln

Abraham Lincoln, the 16th President of the United States, led the country during the American Civil War and is known for abolishing slavery through the Emancipation Proclamation.

Civil War

A conflict between opposing groups within the same country or state, often characterized by intense violence and lasting socioeconomic and political upheaval.

Values

The beliefs and principles that guide an individual's or society's behaviors, decisions, and understanding of what is important in life.

Q9: Which of the following miscellaneous deductions are

Q23: Clark,a widower,maintains a household for himself and

Q30: Indicate in the blank space the date

Q49: The statute of limitations for a tax

Q57: What is the purpose of Schedule C?

Q73: Richard operates a hair styling boutique out

Q83: Under the passive loss rules,real estate rental

Q89: Passive losses are fully deductible as long

Q95: Richard has $30,000 of income from a

Q101: Sherri is a tax accountant.She prepared a