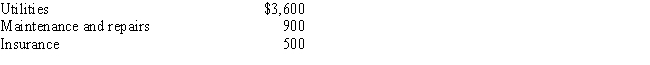

Bill is the owner of a house with two identical apartments.He resides in one apartment and rents the other apartment to a tenant.The tenant made timely monthly rental payments of $550 per month for the months of January through December 2017.The following expenses were incurred on the entire building: In addition,depreciation allocable to the rented apartment is $1,500.What amount should Bill report as net rental income for 2017?

Definitions:

Static Time-Series Method

A forecasting technique that assumes past data patterns will continue into the future without adjusting for dynamic changes.

Historical Data

Past information and data used to analyze trends, forecast future events, and make informed decisions.

Highly Variable

Characterized by large changes or fluctuations, often unpredictably.

Managerial Decisions

Decisions made by managers within organizations that affect the allocation of resources and the direction of operational activities.

Q30: Kim earned $30,000 from Pfizer before she

Q31: Mark each of the following as a

Q31: Tom is employed by a large consulting

Q40: To be eligible for the earned income

Q46: A "correspondence audit" by the IRS is

Q55: Ronald is 92 years old and in

Q56: State sales taxes can be deducted in

Q62: Scott purchases a small business from Lew

Q79: The unmarried taxpayer supports his dependent mother,who

Q80: Most states are community property states.