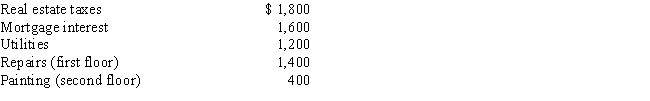

Donald owns a two-family home.He rents out the first floor and resides on the second floor.The following expenses attributable to the total building were incurred by Donald for the year ended December 31,2017: In addition,the depreciation attributable to the entire building would be $2,000.What is the total amount of the expenses that Donald can deduct on Schedule E of Form 1040 (before any limitations) ?

Definitions:

Permanent Storage

Permanent storage refers to non-volatile storage media where data is retained even when power is turned off, such as hard drives, SSDs, and ROM.

CPU Usage Levels

A measure of how much processing power is being used by the central processing unit(s) of a computer.

Recycling Programs

Initiatives designed to process materials to make them suitable for reuse, with the aim of reducing waste and environmental impact.

SSHD Drive

A Solid-State Hybrid Drive combines the faster storage technology of SSDs with the larger capacity of HDDs, aiming to offer a balance between speed and storage space.

Q4: For purposes of the additional 0.9% Medicare

Q36: Joseph exchanged land (tax basis of $34,000),that

Q40: In June of the current year,Rob's wealthy

Q47: Which one of the following is a

Q48: Van is sick and tired of his

Q49: Lew started a business writing a popular

Q89: William,a cash-basis sole proprietor,had the following receipts

Q108: Net operating losses may be carried forward

Q112: In which of the following cases may

Q140: Andy borrows $20,000 to invest in bonds.During