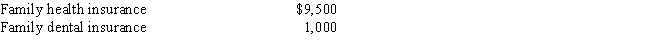

Mike and Rose are married and file jointly.Mike earns $45,000 from wages and Rose reports $450 on her Schedule C as an artist.Since Mike's work does not offer health insurance,Rose pays the following health insurance premiums from her business account:

How much can Mike and Rose deduct as self-employed health insurance?

Definitions:

Subjunctive Verbs

Verbs used to express wishes, hypotheses, or conditions contrary to fact.

Credibility

The quality of being trusted and believed in, often based on the perceived reliability and expertise of the source.

Appropriate Language

Use of words and phrases that are considered suitable for the context and audience, avoiding offensive or slang terms.

Technology

The application of scientific knowledge for practical purposes, especially in industry and improvements in tools, machinery, devices, systems, and methods of organization.

Q13: Lanyard purchased office equipment (7-year property)for use

Q14: Interest on U.S.Treasury Bonds is not taxable.

Q16: During the tax year,Thomas and Yolanda received

Q28: Which of the following is not deductible

Q36: Joseph exchanged land (tax basis of $34,000),that

Q54: An "office audit" is an audit in

Q81: Patricia is a business owner who is

Q102: Jessica and Robert have two young children.They

Q104: Girard is a self-employed marketing consultant who

Q108: After raising two children,Anh,a single 48 year