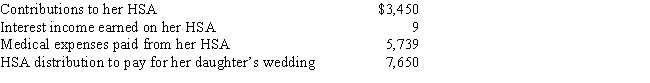

Miki,who is single and 57 years old,has a quaifying high-deductible insurance plan.She had the following transactions with her HSA during the year:

a.How much may Miki claim as a deduction for adjusted gross income?

b.What is the amount that Miki must report on her federal income tax return as income from her HSA?

c.How much is subject to a penalty? What is the penalty percentage?

Definitions:

Resale Value

The estimated market value of an asset at the time of its sale, reflecting what a seller may realistically receive.

Incremental Cash Flow

The additional cash flow generated by a company from taking on a new project or making a new investment.

Tax Rate

The ratio of taxation applied to the earnings of a corporation or a person.

Leasing NET Advantage

An analysis to determine if leasing an asset is more economically advantageous than purchasing it outright.

Q8: Explain the use of the half-year convention

Q10: If the taxpayer fails to locate a

Q36: If a corporation has a short tax

Q38: The child tax credit is $1,000 per

Q47: For the current tax year,David,a married taxpayer

Q64: Mark with a "Yes" if the following

Q76: Arthur,age 19,is a full-time student at Gordon

Q94: Lorreta has a manufacturing business.In the current

Q109: Sally and Jim purchased their personal residence

Q119: Robert is a single taxpayer who has