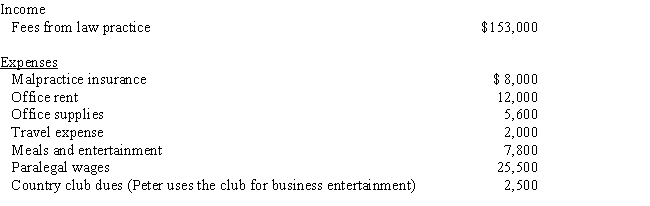

Peter is a self-employed attorney.He gives the following information about his business to his CPA for use in preparing his 2017 tax return:

Peter also drove his car 5,579 miles for business and used the standard mileage method for computing transportation costs.How much will Peter show on his Schedule C for 2017 for:

a.Income

b.Tax deductible expenses

c.Taxable income

Definitions:

Social Services Agency

An organization that provides support and resources for the welfare of the community, particularly for those in need.

Culturally Competent

The ability of healthcare providers to recognize and respect the cultural differences, beliefs, and behaviors of patients, providing effective and appropriate care.

Buddhist Patient

A patient who follows Buddhism, which might influence their healthcare preferences, especially regarding meditation and mindfulness.

Pennsylvania Railroad

A historical American railroad corporation, established in 1846, which became one of the largest and most powerful railroads in U.S. history.

Q7: Jeremy,age 38,has $25,000 in a traditional IRA

Q17: Interest income received by a cash basis

Q57: During the current year,The Jupiter Company,which is

Q60: Mary Lou took an $8,000 distribution from

Q63: If a taxpayer sells his personal residence

Q74: Corporations can elect to deduct up to

Q78: For the year ended June 30,2017,the Rosaceae

Q82: Russell purchased a house 1 year ago

Q97: If a taxpayer is due a refund,it

Q98: George,age 67,and Linda,age 60,are married taxpayers with