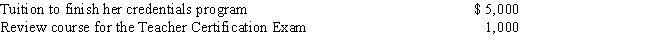

Natasha is a self-employed private language tutor.In 2017,she obtained her teaching credentials,hoping to receive a job as a seventh grade public school English teacher.She had the following education expenses for the year:

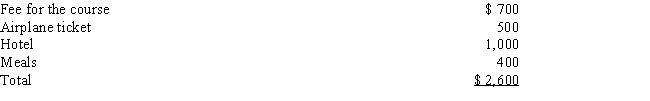

Natasha also attended a seminar in Washington,D.C. ,titled "The Motivated Student." Her expenses for the trip are as follows:

Determine how much of the above expenses are deductible on her Schedule C.

Determine how much of the above expenses are deductible on her Schedule C.

Definitions:

Qualifications

The credentials, skills, or attributes required for an individual to be considered suitable for a specific job or task.

Administrative Skills

The capabilities related to managing tasks, organizing work, and ensuring efficient operation within an office or organization.

Environmental Scanning

The process of systematically examining the external environment to identify opportunities and threats.

Firm Strategy

The plan of action developed by a business to achieve its goals and to compete effectively in its market.

Q6: A business gift with a value of

Q6: During 2017,Howard maintained his home in which

Q34: Jim lives in California.What is Jim's deadline

Q52: The tax law imposes restrictions on the

Q59: The American Opportunity tax credit<br>A)Is 50 percent

Q66: Charles,a corporate executive,incurred business related,unreimbursed expenses in

Q69: Taxpayers can download tax forms from the

Q86: In determining whether an activity should be

Q95: Richard has $30,000 of income from a

Q121: Theodore,age 74,and Maureen,age 59,are married taxpayers with