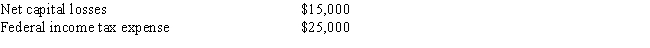

For the current year,the Beech Corporation has net income on its books of $60,000,including the following items: Federal tax depreciation exceeds the depreciation deducted on the books by $5,000.What is the corporation's taxable income?

Definitions:

Relationship-Enhancing

Activities or behaviors aimed at improving the quality and satisfaction of a personal relationship.

Internal Attributions

The process of explaining one's own behavior or the behavior of others based on internal characteristics or dispositions.

External Attributions

The process of attributing someone's behavior to external factors, such as the situation or environment.

Relationship Satisfaction

Refers to the degree of contentment and positivity experienced by individuals in their romantic relationships.

Q2: Kendall is considering the purchase of a

Q3: The text,video,audio,and graphics that are found on

Q44: Patrick has a business net operating loss

Q45: Acacia Company had inventory of $300,000 on

Q66: In the current year,Johnice started a profitable

Q69: Payments made by an employer for health

Q79: Synergy analysis seeks opportunities by finding the

Q84: Marketers produce a customer experience through seven

Q90: During 2017,Murray,who is 60 years old and

Q205: The term _ refers to several methods