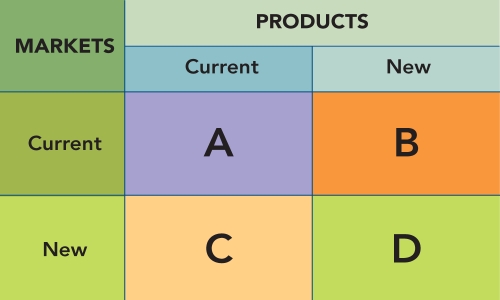

Figure 2-5

Figure 2-5

-Based on Figure 2-5 above,identify and explain each of the four market-product strategies represented by each quadrant ("A," "B," "C," and "D")in the diversification analysis matrix.

Definitions:

Market Rate

The prevailing interest rate available in the marketplace.

Minimum Variance

Minimum Variance is a portfolio strategy or model that seeks to construct a portfolio with the lowest possible volatility or risk for a given level of expected return.

Unsystematic Risk

The risk associated with a specific company or industry, which can be mitigated through diversification in an investment portfolio.

Residual Standard Deviation

A measure of the amount by which an entity's observed values differ from the predicted values, indicating the precision of estimates in regression models.

Q11: Deciding whether to measure the short-term impact

Q35: The Boston Consulting Group (BCG)business portfolio analysis

Q46: The _ element of the marketing mix

Q79: The benefits or customer value received by

Q91: Describe the three components of competition.

Q126: What are the three components of a

Q274: The founder of Chobani Greek Yogurt,who won

Q305: Hoffman-LaRoche Ltd.and BASF AG,two international pharmaceutical companies,were

Q328: If Dr.Pepper plans to grow its proportion

Q390: Today's visionary organization uses three key elements