Scenario E.1

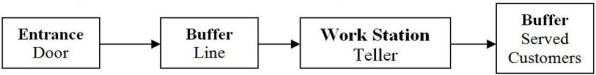

SimQuick is being used to simulate the following bank process:

Customer arrivals at the Entrance Door of the bank with an average time between arrivals of 2.5 minutes. The Line Buffer holds 6 customers. If a customer arrives and the buffer line is filled, the customer leaves. The Work Station Teller's processing time per customer is normally distributed, with a mean of 3.0 minutes and a standard deviation of 0.5 minutes. The Served Customer Buffer in the flow chart is used to count the number of customers processed during the period simulated. A 2-hour period was simulated.

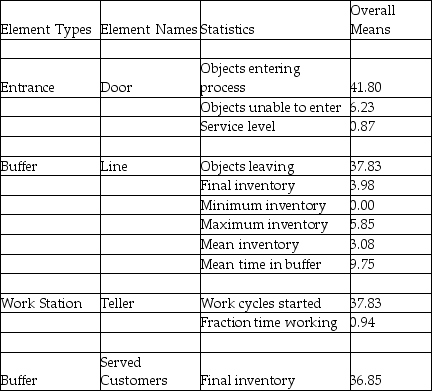

The SimQuick simulation is run, and the results are as follows:

-Use the information in Scenario E.1. Approximately how much time did the average customer who entered the system spend waiting in line?

Definitions:

Credit Cards

Financial instruments issued by banks or financial institutions that allow cardholders to borrow funds with which to pay for goods and services with the obligation to pay back the borrowed money, plus any applicable interest.

Permanent Income Hypothesis

A theory suggesting that people's consumption choices are based on their long-term income expectations rather than their current income.

Induced Consumption

Consumer spending that increases as disposable income rises, and decreases as disposable income falls, unrelated to the level of interest rates.

Wealth Effect

The change in spending that accompanies a change in perceived wealth, typically when home values or investment portfolios increase.

Q1: A double-sampling plan is usually less expensive

Q5: The multinational financial system does NOT enable

Q8: The interest rate is also called the

Q16: Using the information in Table J.10 and

Q21: ERP revolves around a(n)_.

Q30: A(n)_ specializes in medium- to high-volume production

Q46: _ is a priority sequencing rule that

Q49: Using the information in Table J.17 and

Q80: A manufacturer builds finished items A,B,and C

Q116: Use the information in Table J.12.What is