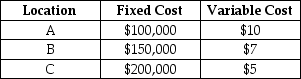

An operations manager has narrowed down the search for a new plant for McIntosh Enterprises to three locations.Fixed and variable costs follow:  Plot the total cost curves in the chart provided and identify the range over which each location would be best.Then use break-even analysis to calculate exactly the break-even quantity that defines each range.

Plot the total cost curves in the chart provided and identify the range over which each location would be best.Then use break-even analysis to calculate exactly the break-even quantity that defines each range.  Which of the following statements is correct?

Which of the following statements is correct?

Definitions:

Sales Taxes Payable

A liability account that represents the amount of sales tax collected from customers by a business, which is owed to the government.

Adjusting Entry

A journal entry made in the accounting records at the end of an accounting period to allocate income and expenses to the correct periods.

Unearned Revenue

Money received by a company for a service or product that has yet to be delivered or provided.

Deferred Revenue

Income received by a company for goods or services yet to be delivered or performed, recorded as a liability on the balance sheet until the goods or services are provided.

Q8: The transportation method of production planning is

Q34: A systematic effort to reduce the cost

Q37: Consider the transportation tableau shown below.What is

Q54: A(n)_ is a portion of data from

Q95: What is a Gantt chart? What does

Q96: Use the information in Table 11.11.Which of

Q97: The SCOR model focuses on the basic

Q100: Use the information from Table 11.1.Calculate the

Q103: The production of 300 units during a

Q155: The pull method begins the production of