Scenario C.3 Consider an Item with the Following Discrete Demand Distribution for Distribution

Scenario C.3

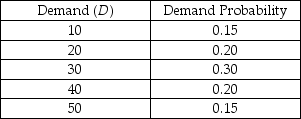

Consider an item with the following discrete demand distribution for a one-period inventory decision.

This item experiences a seasonal demand pattern. A profit of $15 per unit is made if the item is sold in season, but a loss of $10 per unit is incurred if the item is sold after the season is over.

-Use the information in Scenario C.3. What is the payoff when 40 units are ordered but a demand of 50 materializes?

Definitions:

Total Assets

The sum of all current and long-term assets owned by a company, reflecting the total resources at its disposal.

Internal Growth Rate

The maximum growth rate a company can achieve with its existing assets without having to finance growth with external equity or debt.

Retention Ratio

The portion of net income that is retained by a company instead of being paid out as dividends to shareholders, usually expressed as a percentage.

Plowback Ratio

Also known as the retention rate, it refers to the portion of earnings that a company retains and reinvests in its operations rather than distributing as dividends.

Q37: Consider the transportation tableau shown below.What is

Q44: If the total supply does not equal

Q45: According to SA8000:2008 working hours should be

Q46: Automatically stopping the process when something is

Q56: Forward placement is a reduction in inventory

Q57: Use the information in Table 11.6.What is

Q72: There was no reason to build a

Q88: Refer to the instruction above.What are total

Q103: Two conditions must be met by factors

Q117: The theory of constraints accepts existing system