Use the following to answer the questions below.

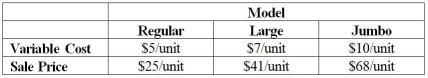

Luvmatics plans to produce a new product.Three different models are planned: the Regular,Large,and Jumbo.The fixed costs depend on which of two locations are used;in San Francisco the fixed costs would be $2.5 million per year,but in Tuttle the fixed costs would be $1.2 million.Sale prices and variable costs for the three models are shown in the table.  Table A.1

Table A.1

-Use the information in Table A.1.How many units of the Regular size must be sold each year to break even if production is at the San Francisco plant?

Definitions:

Interest Rate

The interest rate is the amount charged by a lender to a borrower for the use of assets expressed as a percentage of the principal, often noted annually.

Total Investment

The overall amount of money allocated to purchasing assets or towards spending that is intended to generate future revenue.

Expected Flow

The anticipated movement or transfer of resources, information, or goods in a system over a period.

Future Benefits

The anticipated advantages or improvements in condition and well-being that are expected to occur in the future as a result of certain actions or investments.

Q13: The managers of Alpha and Beta must

Q17: A firm sells two goods X and

Q32: _ is/are examples)of market failure that could

Q36: The time added to adjust for factors

Q41: A restaurant manager tracks complaints from the

Q52: Which of the following statements is more

Q64: Strategic plans are developed farther into the

Q101: A company faces a fixed cost of

Q111: An accounting professor realizes she is woefully

Q150: Which statement regarding learning rates is best?<br>A)A