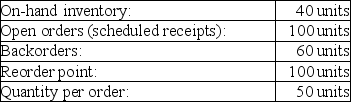

Consider the following conditions for an item used in the Hess Company's manufacturing process:  Which of the following statements best describes Hess's situation regarding inventory replenishment?

Which of the following statements best describes Hess's situation regarding inventory replenishment?

Definitions:

Federal Income Tax

A tax levied by the federal government on individuals' and corporations' yearly income.

Payroll Tax

Taxes imposed on employers and employees, typically calculated as a percentage of the salaries that employers pay their staff.

Benefits Principle

A tax principle stating that those who benefit from government services should pay in proportion to the amount they benefit.

Ability-To-Pay

A principle in taxation that suggests taxes should be levied according to the taxpayer's ability to bear the tax burden.

Q7: The Gantt chart can be used as

Q8: Which one of the following statements about

Q45: Complete the following MPS Record. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1253/.jpg"

Q62: _ is a computerized information system developed

Q62: Inventory _ cost is the variable cost

Q92: Gross requirements are the total demand derived

Q115: Lean systems use the standardization of components

Q117: A risk-management plan contains all identified risks

Q118: Which one of the following statements concerning

Q134: To obtain the latest start and latest