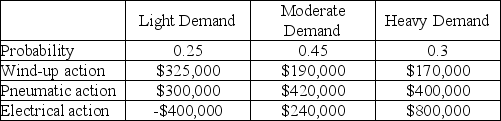

A toy manufacturer has three different mechanisms that can be installed in a doll that it sells.The different mechanisms have three different setup costs (overheads)and variable costs and,therefore,the profit from the dolls is dependent on the volume of sales.The anticipated payoffs are as follows.

a.What is the EMV of each decision alternative?

a.What is the EMV of each decision alternative?

b.Which action should be selected?

c.What is the expected value with perfect information?

d.What is the expected value of perfect information?

Definitions:

Par Value

The nominal dollar amount assigned to a security by the issuer.

Semiannual Interest

Interest that is calculated and paid twice a year, often associated with bonds or loans.

Selling Price

The amount of money charged for a product or service, determined by various factors including cost, demand, and market conditions.

Convertible Bonds

Bonds that can be converted into a predetermined number of the issuing company's shares, at the holder's discretion, typically at certain times during their life.

Q23: A square node on a decision tree

Q26: Which of the following is a location

Q27: Process control is the use of information

Q40: The region which satisfies all of the

Q79: A waiting-line system that meets the assumptions

Q96: A crew of mechanics at the Highway

Q96: Suppose that a maximization LP problem has

Q97: "Making it right the first time" is<br>A)an

Q125: Goods made to order are typical of

Q130: A single-phase waiting-line system meets the assumptions