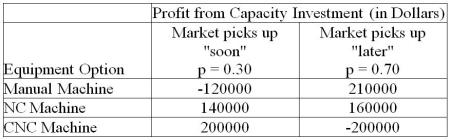

Steve Gentry,the operations manager of Baja Fabricators,wants to purchase a new profiling machine (it cuts compound angles on the ends of large structural pipes used in the fabrication yard).However,because the price of crude oil is depressed,the market for such equipment is down.Steve believes that the market will improve in the near future and that the company should expand its capacity.The table below displays the three equipment options he is currently considering,and the profit he expects each one to yield over a two-year period.The consensus forecast at Baja is that there is about a 30% probability that the market will pick up "soon" (within 3 to 6 months)and a 70% probability that the improvement will come "later" (in 9 to 12 months,perhaps longer).  a.Calculate the expected monetary value of each decision alternative.

a.Calculate the expected monetary value of each decision alternative.

b.Which equipment option should Steve take?

Definitions:

Contingent Liability

A potential financial obligation that may arise depending on the outcome of a future event.

Nontaxable Life Insurance

A type of life insurance policy where the proceeds paid on death or the cash value accumulation during the policyholder's lifetime are not subject to income taxes.

Warranty Expenses

Costs associated with the obligation to repair, replace, or remediate goods that have not met the selling criteria or customer expectations.

Pretax Financial Income

Income calculated before taxes are applied, representing a company's earnings based solely on its operations and other financial activities.

Q9: The decision criterion that would be used

Q33: Which of the following is most likely

Q36: A telecommunications firm is planning to lay

Q49: The Learning-Curve Coefficients table reports that for

Q77: Which of the following characteristics best describes

Q81: The main advantage of a product-oriented layout

Q93: A job shop is an example of

Q126: Among the following choices,an operations manager might

Q133: What is the waiting-line problem? Why is

Q160: McDonald's "Made for You" kitchen system represents