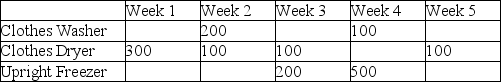

The following table is an example of a(n)

Definitions:

Net Present Value (NPV)

Net Present Value is a method used in capital budgeting to evaluate the profitability of an investment or project, calculating the present value of all cash inflows and outflows using a specified discount rate.

Internal Rate of Return (IRR)

The discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero, used in capital budgeting to estimate the profitability of potential investments.

Payback Method

An investment appraisal technique that calculates the time needed for an investment to generate cash flows sufficient to recover the initial cost.

Weighted Average Cost of Capital (WACC)

A calculation of a company's cost of capital in which each category of capital (debt, equity) is proportionally weighted.

Q28: Preventive maintenance is nothing more than keeping

Q32: A master production schedule specifies<br>A)the raw materials

Q35: When implemented as a comprehensive manufacturing strategy,JIT,TPS,and

Q69: Great Southern Consultants Group's computer system has

Q72: A manufacturing company is trying to determine

Q88: The textbook illustrates demand management in the

Q107: Which of the following best describes a

Q109: Consider a product that is "settled in."

Q115: When depot service is compared to operator

Q141: Even though a firm may have a