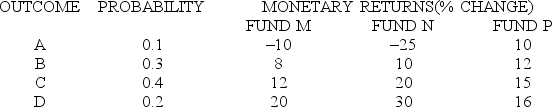

A financial analyst considers three funds. The funds' estimated returns depend on future economic conditions - summarized by outcomes A, B, C, or D. The table lists the probabilities of these outcomes and each fund's expected return for each outcome.

(a) Which fund has the greatest expected monetary return?

(a) Which fund has the greatest expected monetary return?

(b) Comment on the appropriateness of the expected-value criterion.

Definitions:

FIFO

First-In, First-Out, an accounting method where the oldest inventory items are recorded as sold first.

ROE

ROE, or Return on Equity, measures a corporation’s profitability by revealing how much profit it generates with the money shareholders have invested.

Investments

The act of allocating resources, usually money, with the expectation of generating an income or profit.

Compound Leverage Factor

A metric used to evaluate the effectiveness of using borrowed funds or financial derivatives to increase investment returns.

Q6: What is meant by market skimming?<br>A) The

Q12: Discuss the differences between one-shot bargaining situations

Q13: Will a profit-maximizing firm typically sell a

Q13: Which of the following statements is true

Q19: What is the function of a serine/threonine

Q25: Which one of the following is not

Q36: When a chemical firm is required to

Q37: In an oligopoly, the kinked demand curve

Q39: Follow-up experiments to those in adult flies

Q44: The difference between the predicted value and