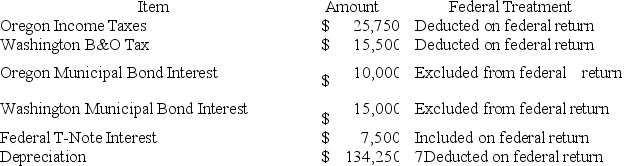

Moss Incorporated is a Washington corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:

Moss' Oregon depreciation was $145,500. Moss' Federal Taxable Income was $549,743. Calculate Moss' Oregon state tax base.

Moss' Oregon depreciation was $145,500. Moss' Federal Taxable Income was $549,743. Calculate Moss' Oregon state tax base.

Definitions:

Break-Even Point

The point at which total costs match total revenue, meaning there is neither profit nor loss.

Sales Differential

Sales differential is the difference in sales volume between a company’s actual sales and a predetermined benchmark, such as past sales performance or market expectations.

Core Value

Fundamental beliefs or principles that guide an organization's actions and decision-making.

IBM

International Business Machines Corporation, a global technology company known for its computer hardware, software, and IT services.

Q1: Bruin Company reports current E&P of $200,000

Q9: In Learning from Experience: Indra Nooyi, the

Q28: In Communication Competency: John Legere, CEO of

Q40: Philippe is a French citizen. During 2018

Q43: To be eligible for the "closer connection"

Q80: Holmdel, Inc., a U.S. corporation, received the

Q82: No deductions are allowed when calculating the

Q85: Suppose Clampett, Inc. terminated its S election

Q89: Which of the following isn't a requirement

Q115: Clampett, Inc. converted to an S corporation