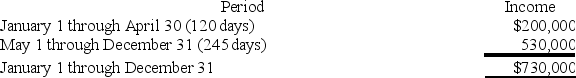

ABC was formed as a calendar-year S corporation with Alan, Brenda and Conner as equal shareholders. On May 1, 2018, ABC's S election was terminated after Conner sold his ABC shares (one-third of all shares) to his solely owned C corporation Conner, Inc. ABC reported business income for 2018 as follows (assume that there are 365 days in the year):

If ABC uses the specific identification method to allocate income, how much will it allocate to the S corporation short year and C corporation short year?

If ABC uses the specific identification method to allocate income, how much will it allocate to the S corporation short year and C corporation short year?

Definitions:

Machine-Hours

The total number of hours that machinery is operating, used in cost accounting to assign machine-related costs to items.

Round Calculations

The process of adjusting numerical values to a specified degree of precision, often used in financial and statistical analysis to simplify figures.

Machine-Hours

A measure of production time, quantifying the hours a machine is operated in the manufacturing of a good.

Activity Rate

The activity rate is a cost accounting term that refers to the rate at which indirect costs are allocated to products or services based on specific activities.

Q2: Russell Starling, an Australian citizen and resident,

Q12: The requirements for tax deferral in a

Q15: This year Don and his son purchased

Q22: Once a month, the employees in Tonya's

Q41: Alexis transferred $400,000 to a trust with

Q60: Sweetwater Corporation declared a stock distribution to

Q65: In general, a temporary difference reflects a

Q70: What step of the organizational socialization process

Q79: Which of the following is a true

Q95: Suppose at the beginning of 2018, Jamaal's