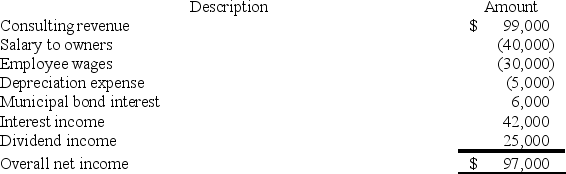

RGD Corporation was a C corporation from its inception in 2013 through 2017. However, it elected S corporation status effective January 1, 2018. RGD had $50,000 of earnings and profits at the end of 2017. RGD reported the following information for its 2018 tax year.

What amount of excess net passive income tax is RGD liable for in 2018? Assume the corporate tax rate is 21%. (Round your answer for excess net passive income to the nearest thousand).

What amount of excess net passive income tax is RGD liable for in 2018? Assume the corporate tax rate is 21%. (Round your answer for excess net passive income to the nearest thousand).

Definitions:

Thomas E. Dewey

An American politician who served as the Governor of New York and was the Republican candidate for the U.S. Presidency in 1944 and 1948, famously losing the latter in a close race to Harry S. Truman.

New York Governor

The chief executive of the State of New York, responsible for enforcing state laws and overseeing the operation of the state government.

Colonialism

The policy or practice of acquiring full or partial political control over another country, occupying it with settlers, and exploiting it economically.

Franklin D Roosevelt

The 32nd President of the United States, who served four terms from 1933 to 1945 and led the country during the Great Depression and World War II.

Q9: On March 15, 20X9, Troy, Peter, and

Q10: Which of the following is incorrect regarding

Q18: A section 338 transaction is a stock

Q52: Built-in gains recognized fifteen years after a

Q55: Subpart F income earned by a CFC

Q68: Which of the following best describes the

Q74: Separately stated items are tax items that

Q82: Temporary differences create either a deferred tax

Q88: A rectangle with a triangle within it

Q105: Publicly traded corporations cannot be treated as